Highlights

More fallout from the wrath of the CoronaVirus and tumbling stock market. The Northern Plains braces for yet one more winter storm to finish out the season of snow and ice. Some areas of North Dakota are expected to get anywhere form 5-10” of snow. President Trump talks of the next tow weeks being very stressful/painful for a whole host of reasons as virus continues to move through the US.

- DJIA closed down 973 at 20943, and NASDAQ closed down 339 at 7360.

- The gold market was off 5-6 bucks, on a bout of profit taking as virus cases were on the rise in India.

- The next USDA report is scheduled for April 9th at 11 AM with the March 1 stocks data factored into the updated US balance sheets, along with updated world balance sheets.

Corn

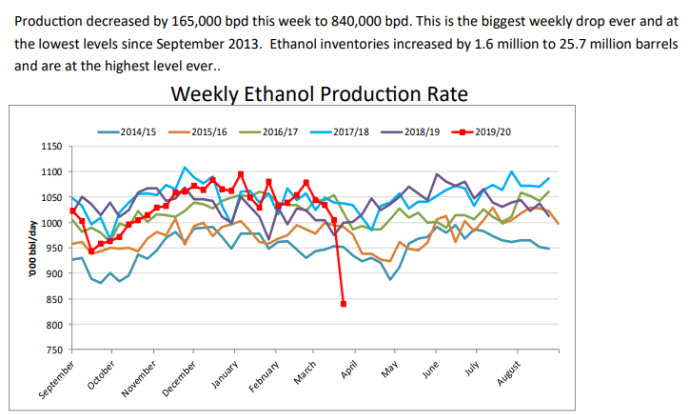

Corn prices traded lower making new lows in most contracts. Ethanol production tanked last week from the sharp declines in gasoline demand. Many folks now work from form or are simply out of a job from the ongoing spread of the CoronaVirus. These conditions will most likely stay that way for the next few weeks.

- Closes: May at $3.34 ¾, down 000, July at $3.38 ¾, down 000, September at $3.40 ¾, down 000, December at $3.47 ¼, down 000.

- Gulf premiums were 1 cent firmer for April and unchanged for May.

- Weekly ethanol production numbers for last week plummeted 165k barrels per day to 840k barrels per day.Massive drop and impact on the corn/ethanol market. Stocks rose to record levels of 25.7 million barrels.

- The average trade estimate for tomorrow’s weekly export sales report: 700 tmt-1.3 mmt.

- Spreads: K/N 4 carry, N/U 2 carry, N/Z 8 ½ carry, Z/N1 21 ¾ carry.

Oilseeds

The soy complex fell because of the CoronaVirus and more sharp losses in outside markets.

- Closes: May at $8.62 ¾, down 23 ¼ cents, July at $8.67 ¼, down 22 ¾ cents, August at $8.68 ¾, down 20 ¼ cents, November at $8.63 ½, down 14 ½ cents. The products were weaker with meal down 6-7 bucks and oil down 96 points.

- Gulf premiums were

- Average trade estimated for tomorrow’s weekly export sales report: 375 tmt-1.0 for beans, 100-350 tmt for meal and 8-45 tmt for oil.

- USDA reported the February soybean crush at 182.0 mb, well above the 176.0 mb the trade was expecting.

- The canola market traded lower in sympathy with the US soy complex and stock market. More downside is expected with weaker margins.

- Spreads: K/N 4 ½ carry, N/Q 1 ½ carry, N/X 3 ¾ inverse, X/F 1 inverse, X/N1 11 ¾ inverse.

Wheat

Wheat prices tumbles on broad selling across most commodities and a stronger US$. Price weakness stemmed from heightened fears of the spread of the CoronaVirus and the toll it’s taken on the global economy.

- May closes: Mpls at $5.24 ½, down 14 ¾ cents, KC at $4.75, down 18 cents, Chicago at $5.50 ¼, down 18 ½ cents.

- Weekly export sale for tomorrow range from 250-950 tmt.

- Egypt was set to tender for wheat this afternoon, and then later canceled their tender with no reason given.

- Paraguay is expected to reap a record wheat crop this year from beneficial weather conditions.

- Spreads: Mpls K/N 10 ¼ carry, Kansas City K/N 7 ½ carry, Chicago K/N 2 ½ inverse.